Follow The Smart Money

Build. Rent. Earn.

We Are in Good Company

Built for Investors. Designed for Performance.

We are a fee-based Build-to-Rent developer — we build new homes for investors seeking steady rental income and long-term wealth.

You own the land. You own the home. You have control. We build it for you — efficiently, transparently, and designed to perform.

Each property is located in a high-growth market, planned for maximum rentability, and delivered turnkey and ready to lease.

Through our online platform, investors track every step of construction in real time — from foundation to final inspection — with complete visibility and confidence.

A smarter way to invest in real estate: direct ownership, immediate income potential, and full control over your portfolio.

Featured Market

Discover North Port–Sarasota

Discover North Port–Sarasota, one of Florida’s fastest-growing regions — a vibrant, high-demand market where smart investors are building wealth through Build-to-Rent homes designed for lasting performance.

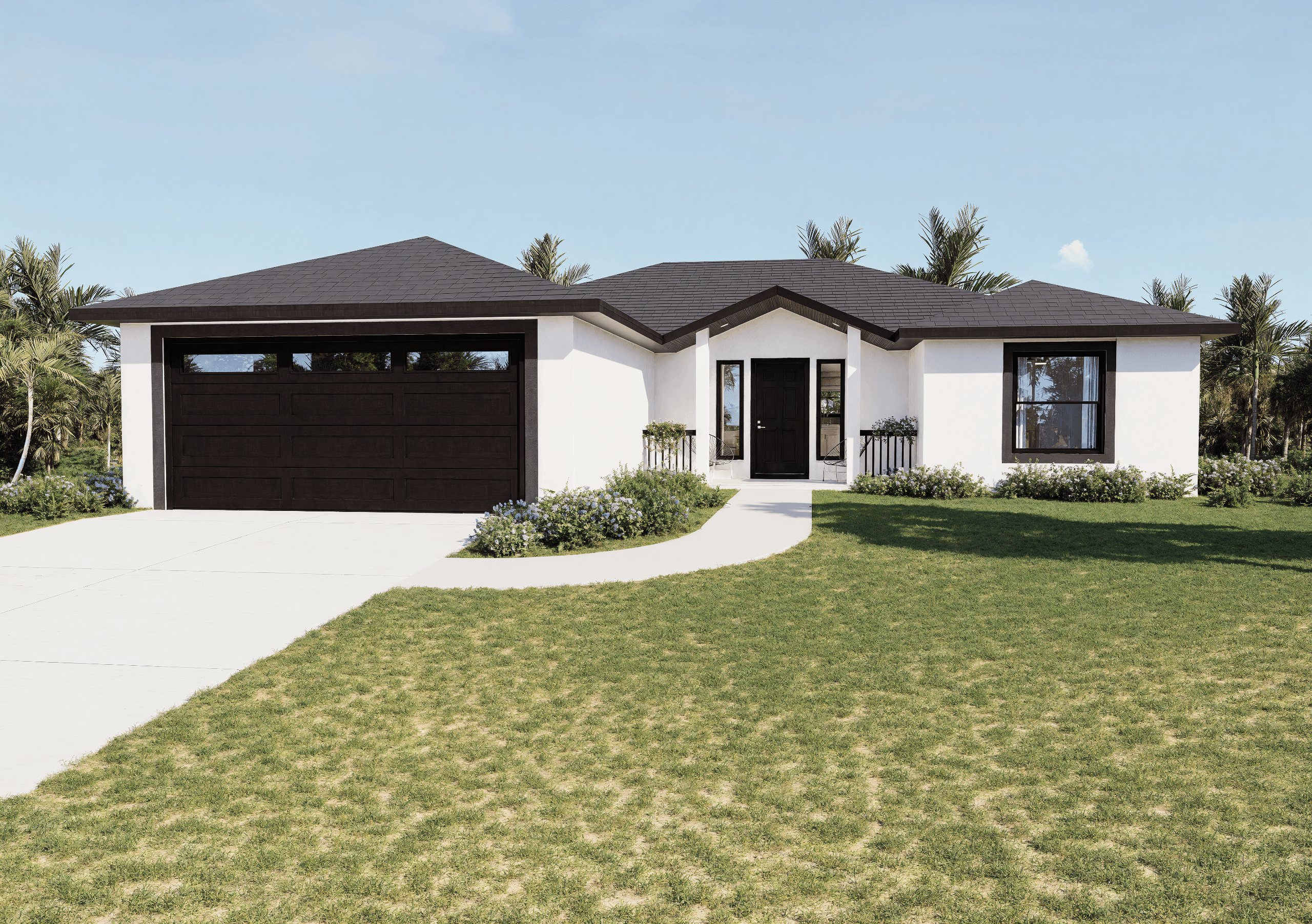

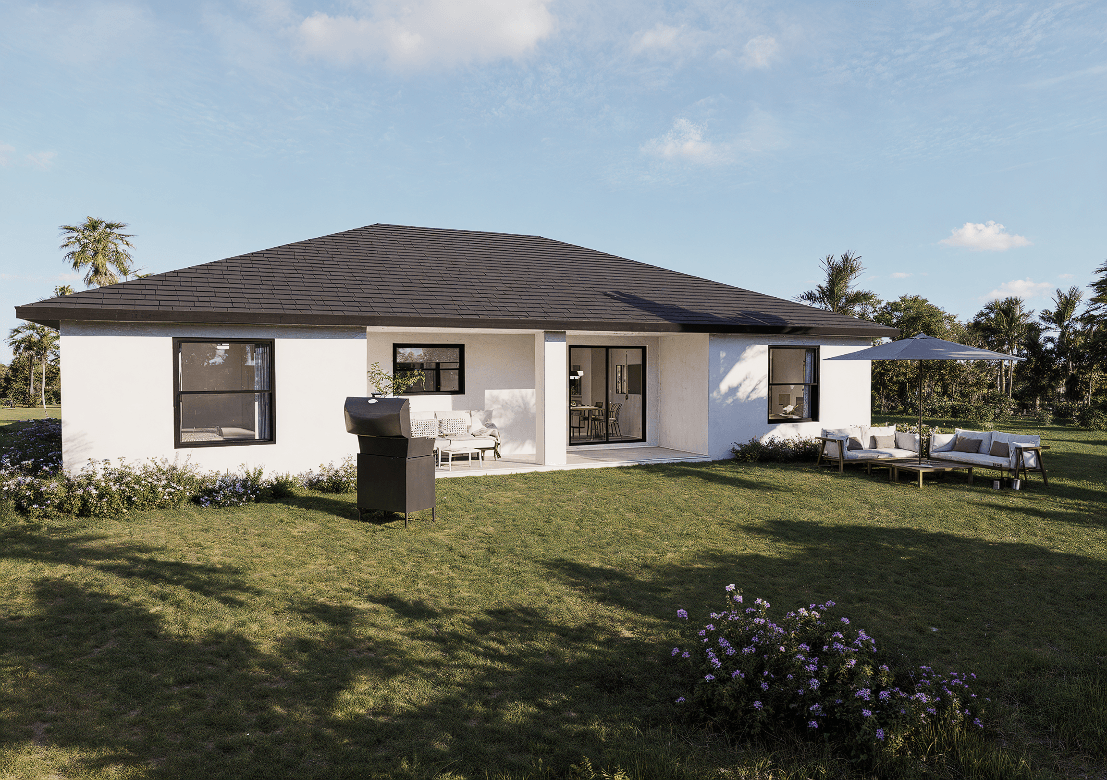

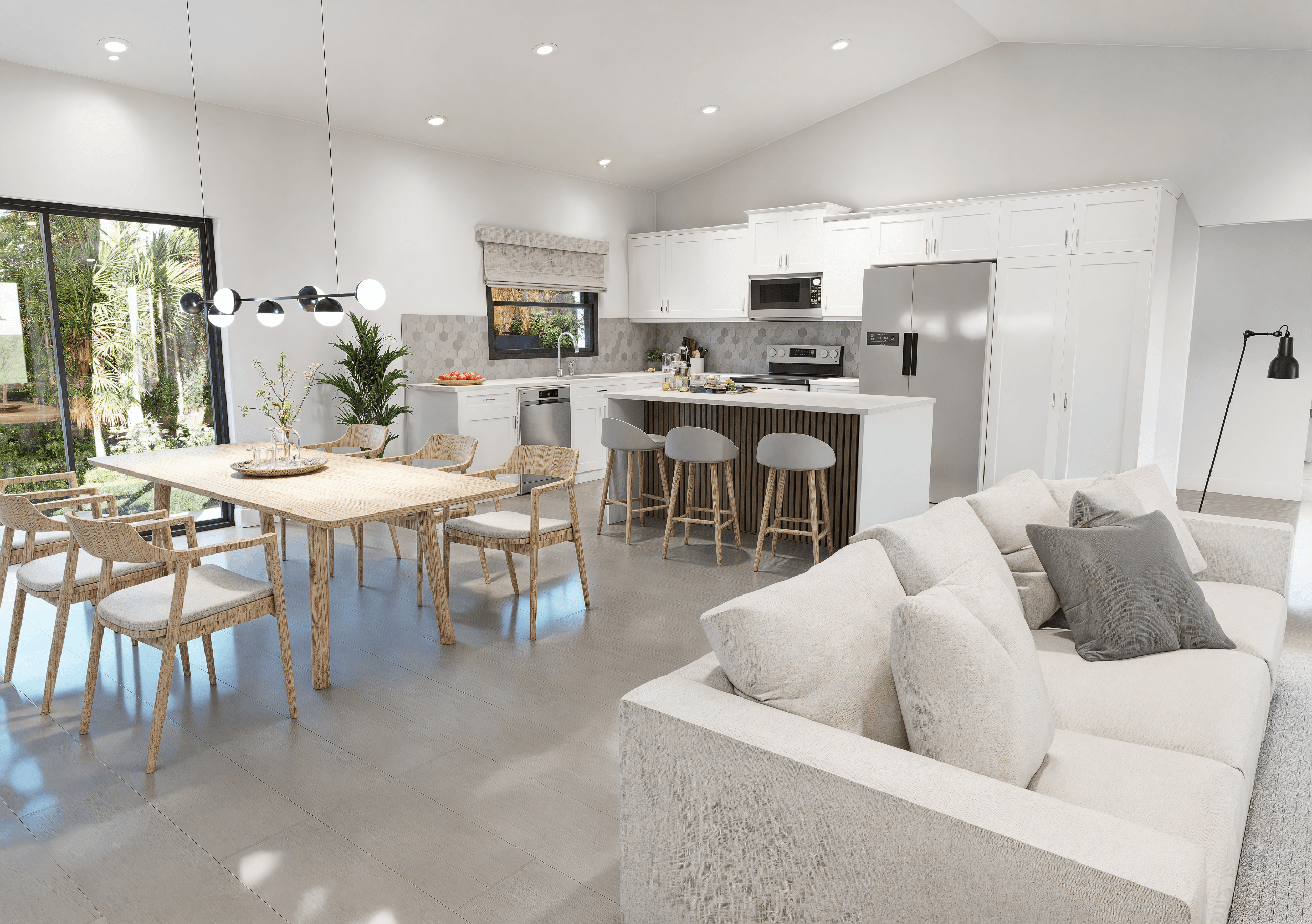

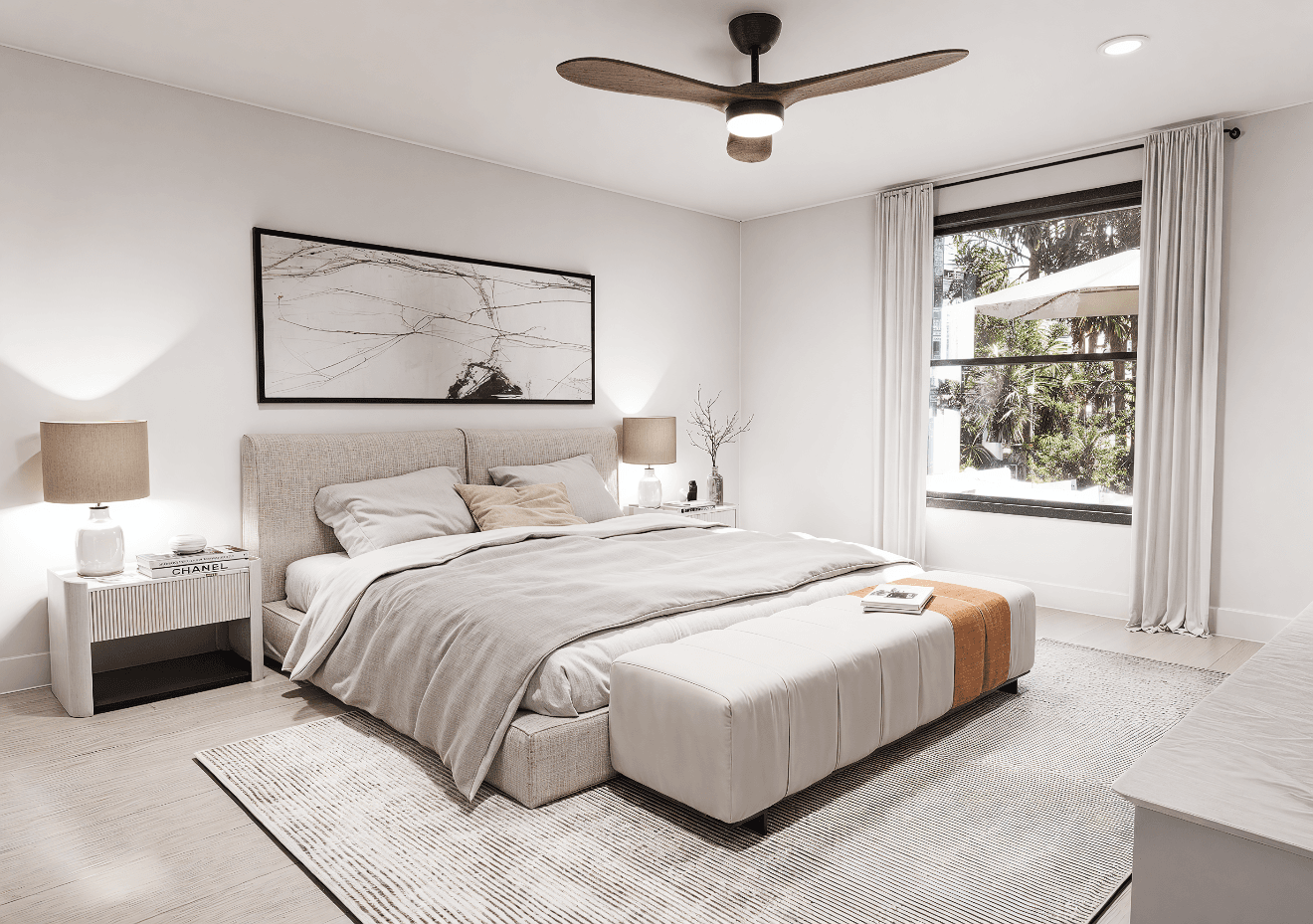

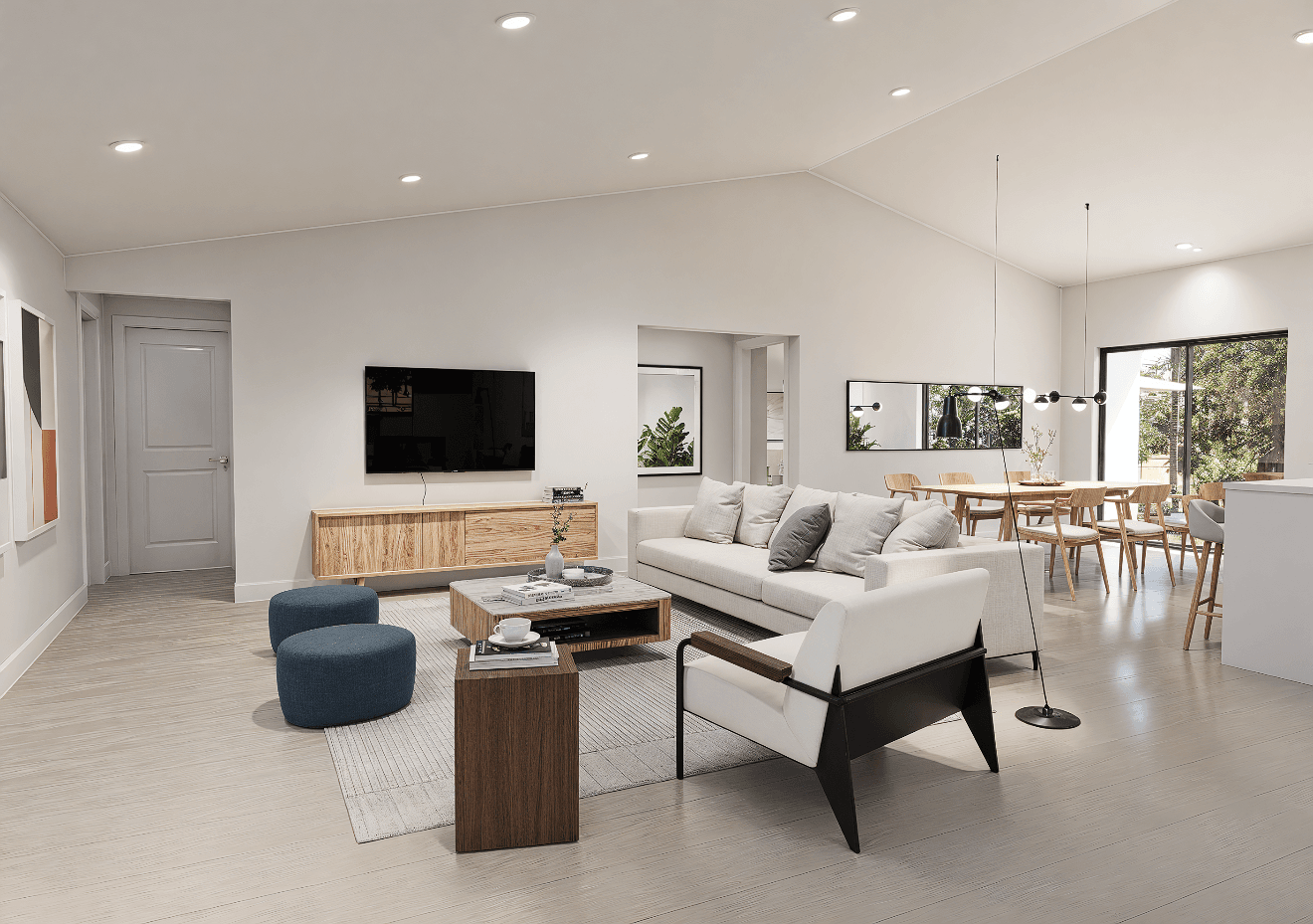

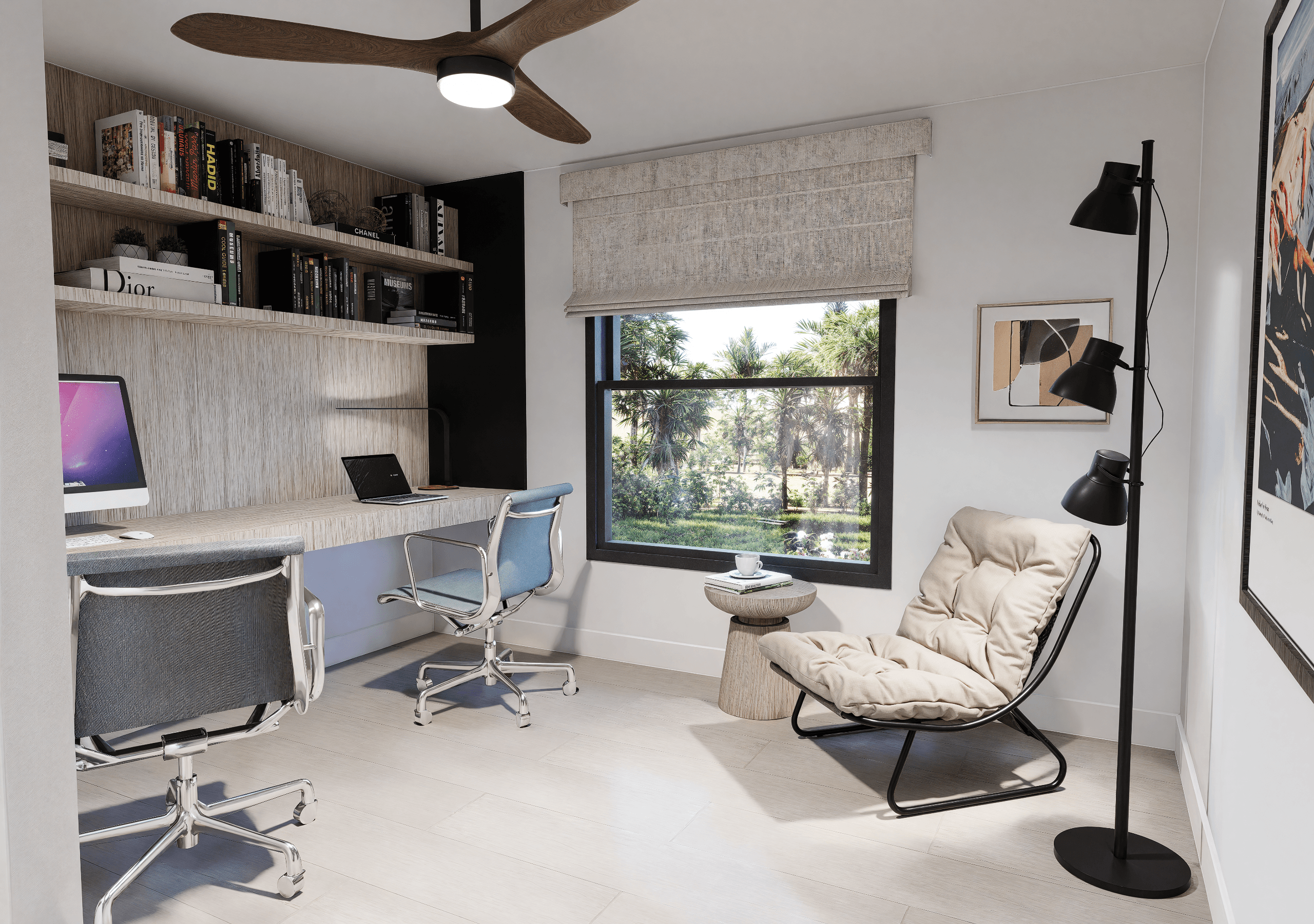

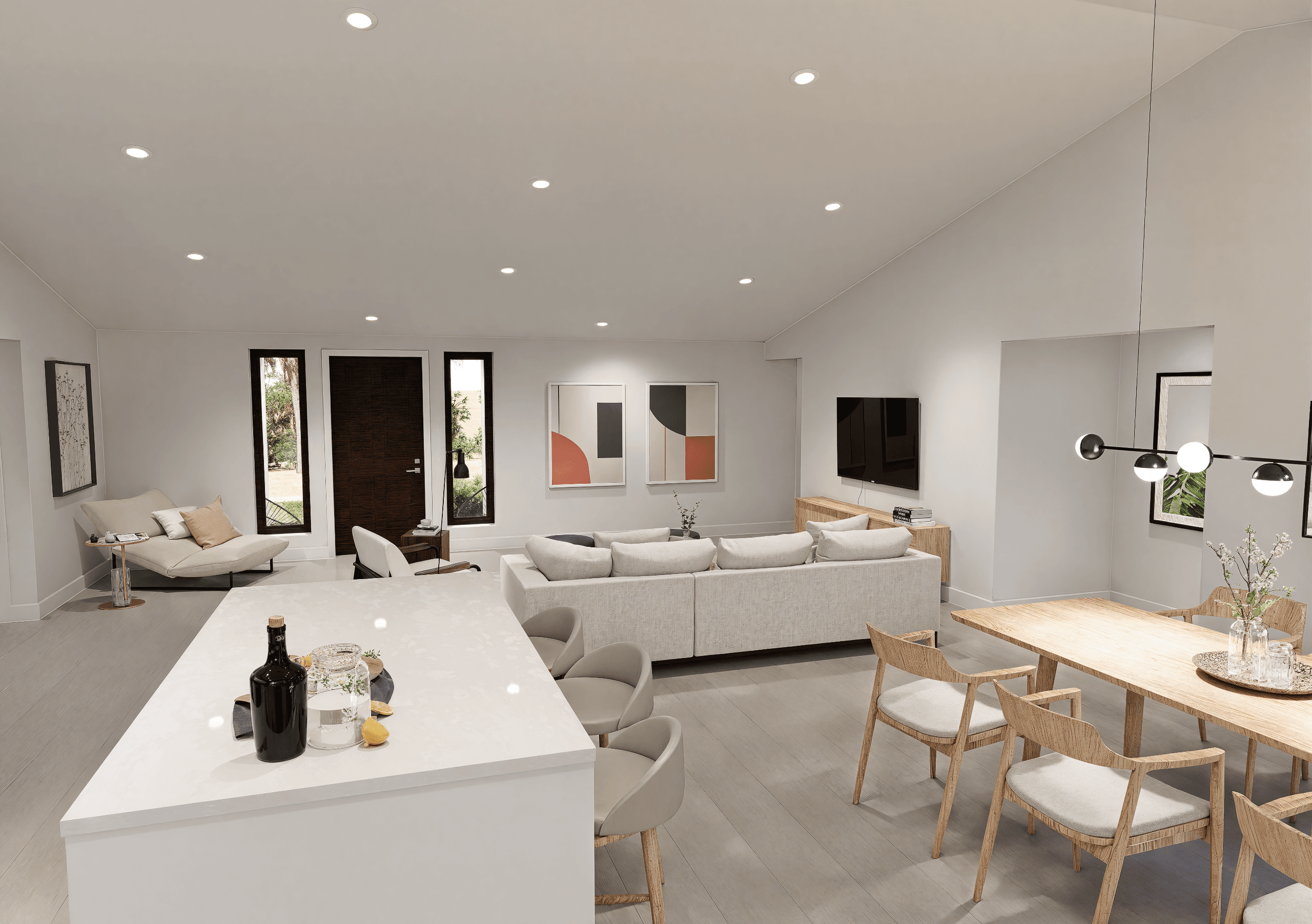

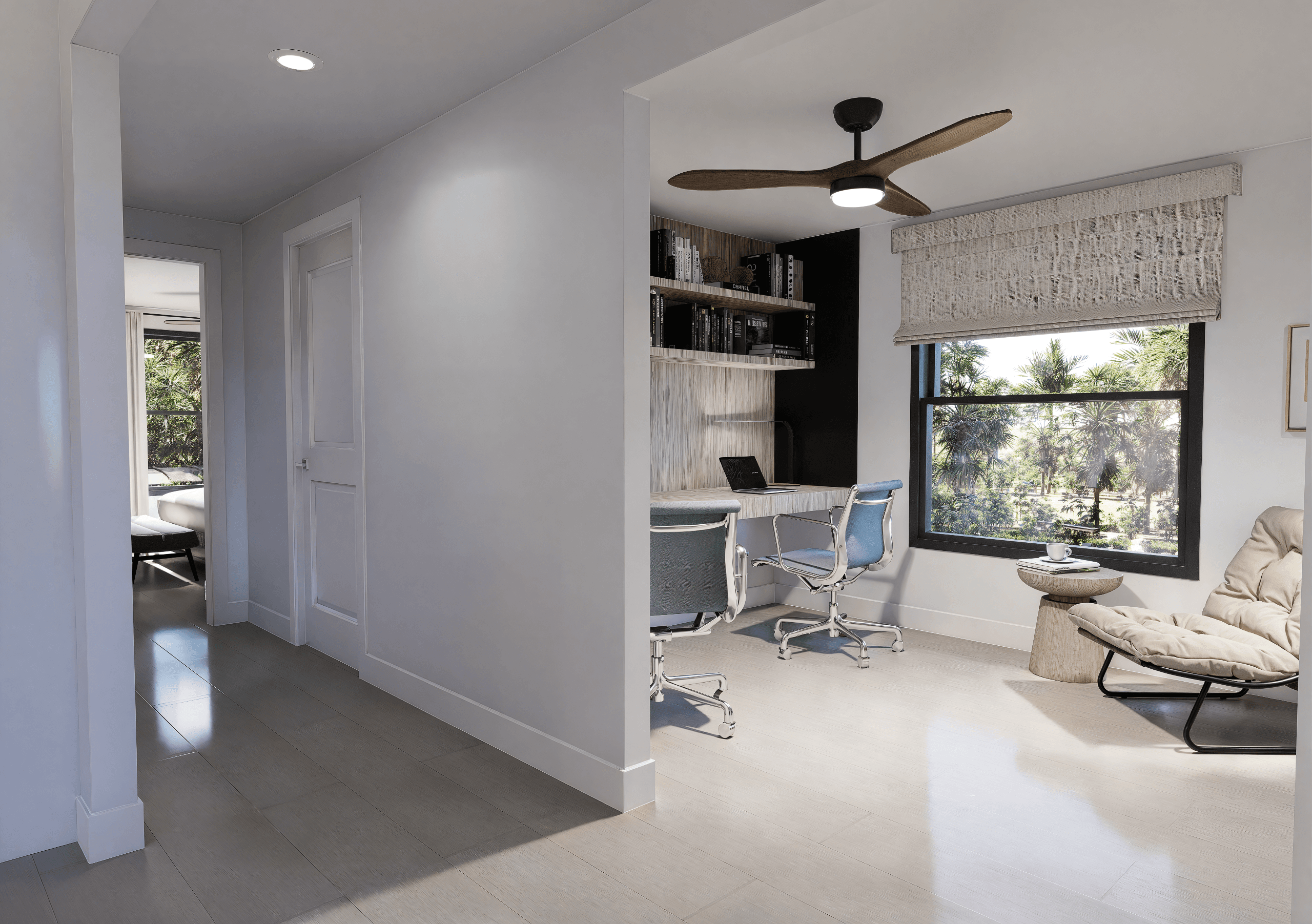

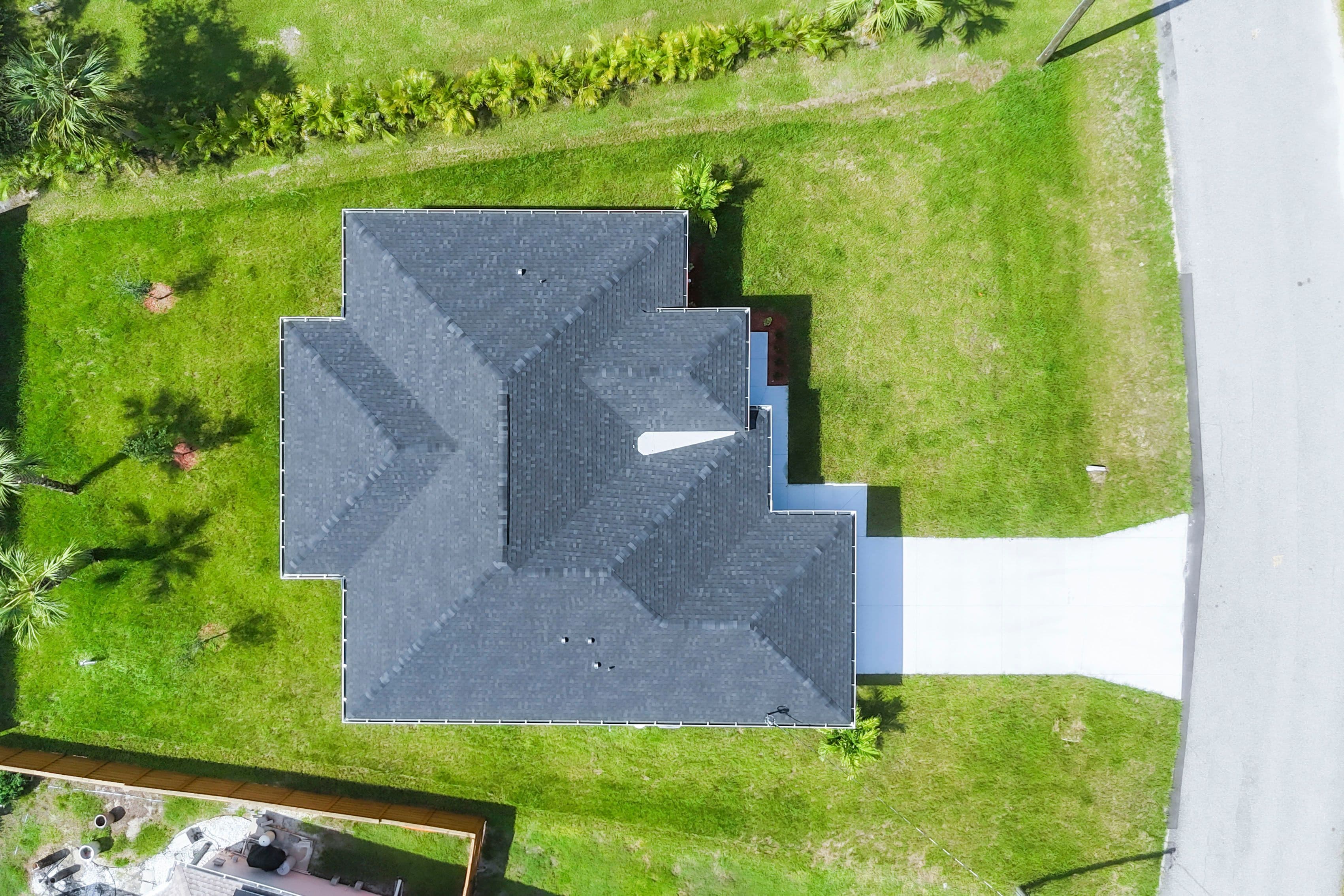

The Everglades House

Designed for Living, Built for Returns

Our flagship Build-to-Rent home, the Everglades, is thoughtfully engineered to maximize rental performance and long-term value. Its flexible design, durable construction, and modern features make it ideal for today’s families and investors alike.

Investment Overview

Live Projections

Minimum Investment

$125,000

IRR Projection

16% annual

Equity Multiple

1.5x

Term

3+ years

Yield

6%

Cashout

≈30% with ReFi

Distribution

Monthly